Deposit rates in Cyprus rose in December 2025 for both households and businesses, according to data published on Wednesday by the European Central Bank and the Central Bank of Cyprus. Despite the increase, the country still records the third lowest household deposit rates in the eurozone and the lowest for businesses.

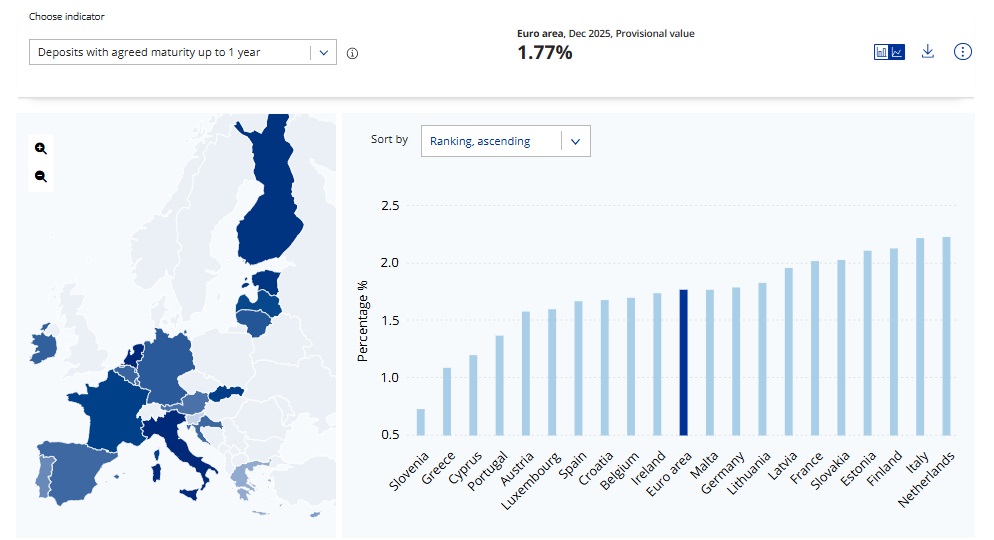

For households, the interest rate on time deposits of up to one year increased to 1.20 per cent, compared with 1.13 per cent in the previous month. Even with the rise, Cyprus remains near the bottom of the eurozone, ahead only of Slovenia at 0.73 per cent and Greece at 1.09 per cent. In contrast, depositors in the Netherlands enjoy the highest rate at 2.23 per cent.

According to the Central Bank, the low rates reflect the high liquidity of Cypriot banks, which is among the strongest in the eurozone. Indicatively, the Liquidity Coverage Ratio in Cyprus reached 319 per cent in December 2025, compared with a median of 191 per cent and an average of 161 per cent in the European Union in September 2025. The limited size of the Cypriot banking market also plays a role.

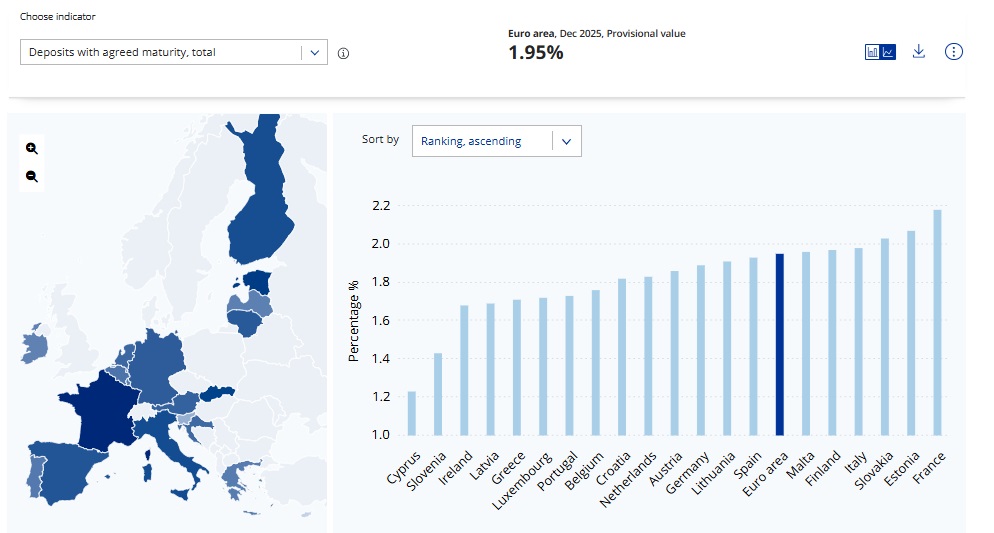

For non financial corporations, the corresponding interest rate on deposits rose to 1.27 per cent, up from 1.17 per cent the previous month. Deposit rates offered to businesses in Cyprus are the lowest in the eurozone. By contrast, companies in France and Estonia receive the highest rates.

Loan interest rates

Loan interest rates on outstanding balances in Cyprus are close to the eurozone median. The margin is effectively zero for households and stands at 0.3 per cent for non financial corporations.

For new loans to households for house purchase, the margin of the weighted average interest rate is at minus 0.3 per cent, meaning it is lower than the eurozone median. For non financial corporations, the corresponding margin is 0.6 per cent.