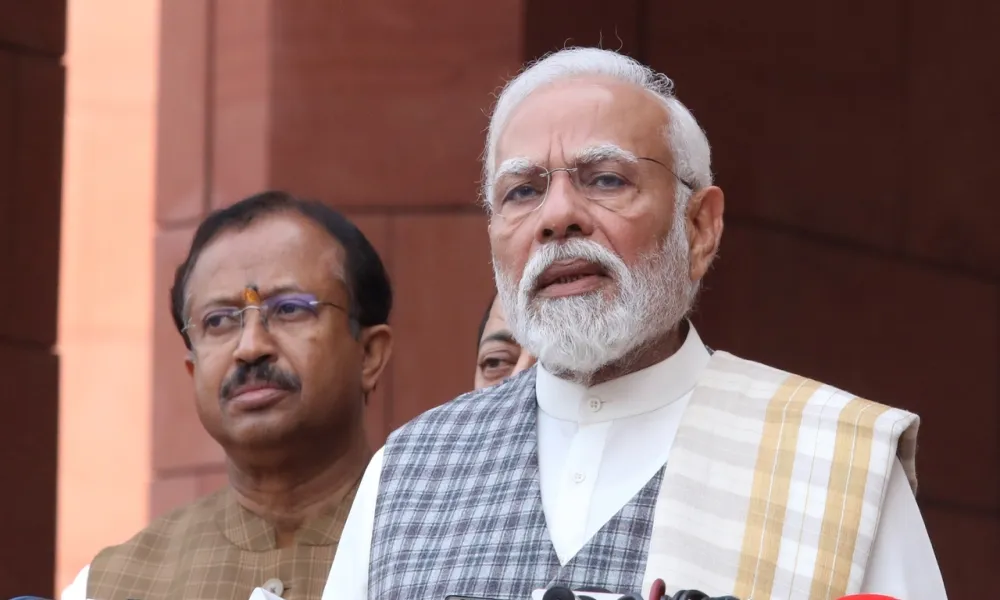

A new trade understanding between US President Donald Trump and Indian Prime Minister Narendra Modi has shifted from relief to controversy in New Delhi, as details of the agreement trigger political and economic backlash.

Earlier this month, Trump announced the immediate removal of a punitive 50 percent tariff on most Indian exports to the United States. The revised rate now stands at 18 percent, broadly in line with India’s Asian competitors. Modi publicly thanked Trump, presenting the move as a diplomatic win.

$500 billion commitment raises questions

Under the framework outlined by Washington, India has committed to purchase $500 billion worth of American goods over five years, effectively doubling its imports from the United States.

The pledge has raised concerns among opposition lawmakers and policy analysts, who argue that the scale of the commitment could strain domestic industries and reduce policy flexibility.

India’s parliamentary opposition has described the deal as a “wholesale surrender” of national interests. Cabinet ministers have so far avoided detailed explanations regarding the full scope of the agreement.

Russian oil at the centre of tension

A joint statement issued by US and Indian negotiators did not explicitly mention Russia. However, a subsequent White House fact sheet stated that the tariff reduction came “in recognition of India’s commitment to stop purchasing Russian Federation oil.”

Indian officials declined to clarify whether such a commitment had formally been made.

India has maintained a position of strategic neutrality since Russia’s 2022 invasion of Ukraine, balancing energy needs and longstanding defence ties with Moscow. Any perceived alignment with Washington on oil imports risks domestic political fallout and diplomatic recalibration.

Farmers mobilise over agricultural imports

The US statement indicated that India would lower tariffs on American agricultural goods, including fruit, soybean oil and “certain pulses.” Pulses, a staple in the Indian diet and central to rural livelihoods, carry strong political sensitivity.

Although later revisions removed the reference to pulses, farmers’ unions remain unconvinced. The Samyukt Kisan Morcha, an umbrella body representing agricultural groups, has called the agreement a “total surrender” and announced strike action.

Agriculture has previously tested Modi’s authority. Large-scale farmer protests in 2020 forced the government to withdraw reform measures seen as threatening rural incomes.

Business support turns cautious

Indian markets initially reacted positively, with equities rising and the rupee strengthening following the tariff announcement. Major conglomerates welcomed the move as a boost to growth.

However, enthusiasm has cooled as further US trade moves complicate the picture. A separate American agreement with Bangladesh could provide that country’s garment exporters with a competitive edge over India’s textile industry.

Industry groups are now seeking clarification on how the new arrangements will affect Indian manufacturers already facing pressure from China and Vietnam.

Between relief and risk

For Modi, the agreement delivered a clear short-term gain by reversing steep tariffs that had penalised Indian exporters. But the broader trade-offs are increasingly under scrutiny.

Critics argue that closer economic alignment with Washington may narrow India’s strategic autonomy, particularly on energy and digital trade policy. Supporters maintain that improved access to the US market outweighs the risks.

What began as a diplomatic breakthrough is now evolving into a domestic political test, as the government faces demands for transparency over what exactly India has conceded in exchange for tariff relief.

Source: The New York Times